Fill out this schedule to itemize your deductions The other federal tax Form 1040 Schedules include the following: Fill out this schedule to report your foreign address or third-party designee. Schedule 6, Foreign Address and Third-Party Designee.Besides, you can file this schedule for other payments such as an excess social security tax withheld or the amount paid with an extension to file a request. The refundable credit claimed on this schedule does not include the American opportunity credit, additional child tax credit, and an earned income credit. Schedule 5, Other Payments and Refundable Credits.Complete this schedule to report other taxes you need to pay (e.g., household employment taxes, self-employment taxes, qualified retirement plans, and tax-favored accounts). Do not use it to claim a child tax credit or a credit for other dependents. Attach this schedule to claim a nonrefundable credit, like an education credit, foreign tax credit, or general business credit. Use this schedule when you have to make an excess advance premium tax credit repayment or to report the sum you owe for the Alternative Minimum Tax. This schedule also fits to claim deductions, e.g., self-employment tax, educator expenses, or student loan interest deductions. Fill out this form to report additional income, like gambling winnings, prize money, capital gains, or unemployment compensation.

Schedule 1, Additional Income and Adjustment to Income.

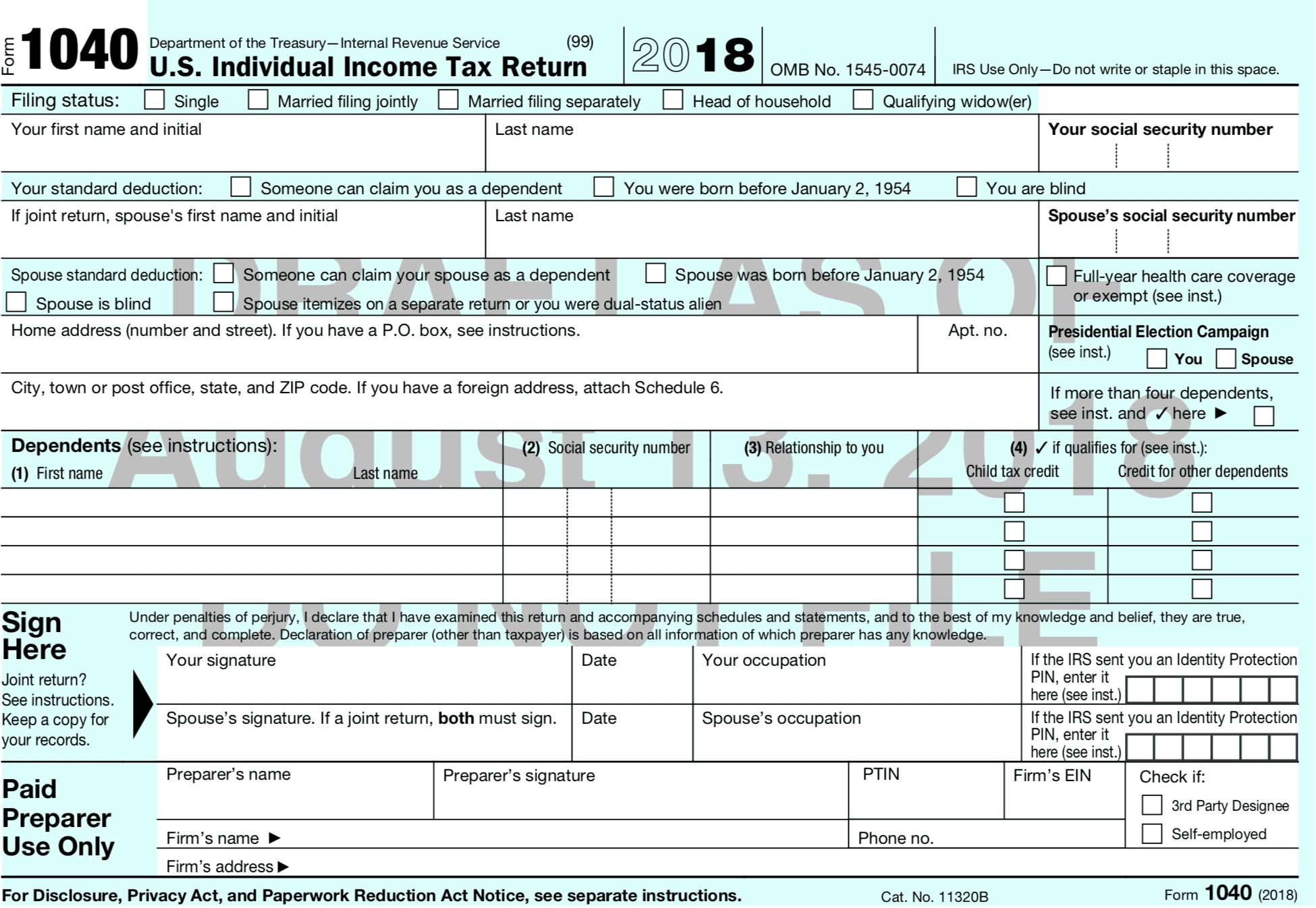

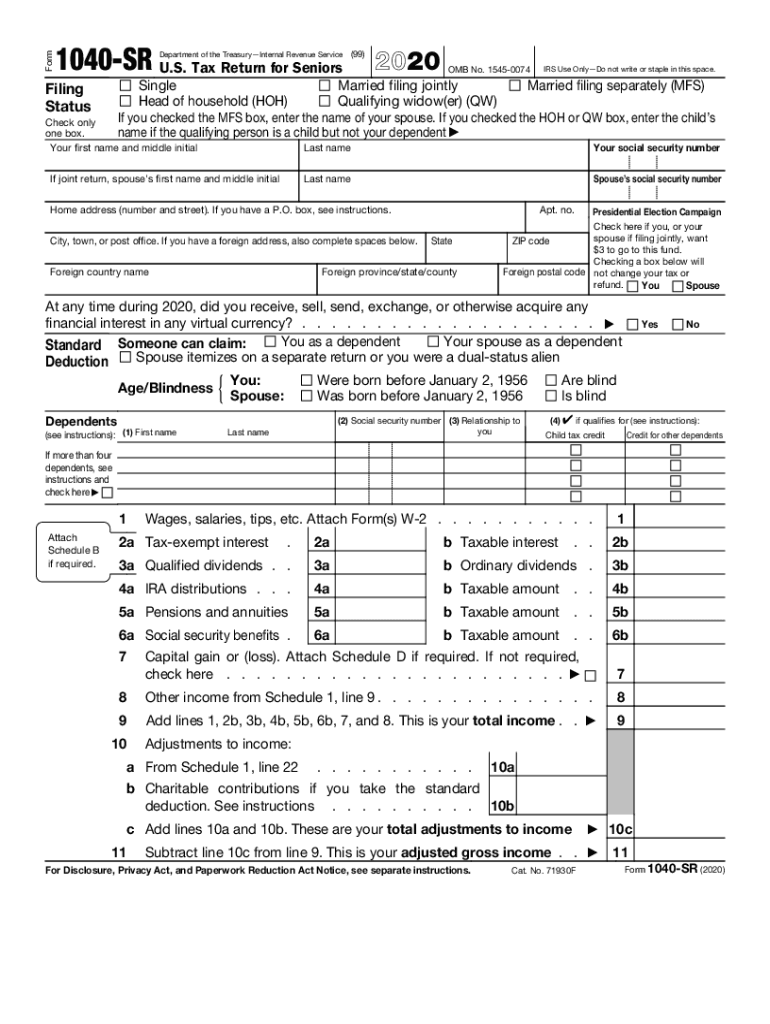

The redesigned version of the IRS 1040 Form includes a number of new schedules:

During the last revision, the form was shortened and redesigned.

0 kommentar(er)

0 kommentar(er)